CANADA SILVER COBALT RELEASES MAIDEN NI 43-101 MINERAL RESOURCE ESTIMATE FOR CASTLE EAST ROBINSON ZONE

Canada Silver Cobalt Works Inc. (TSXV: CCW) (OTC: CCWOF) (Frankfurt: 4T9B) (the “Company” or “Canada Silver Cobalt”) is pleased to announce the results of its first NI 43-101 Mineral Resource estimate for the early stage Castle East Robinson Zone discovery in the heart of the past producing Gowganda Silver Camp, 75 kilometers southwest of Kirkland Lake.

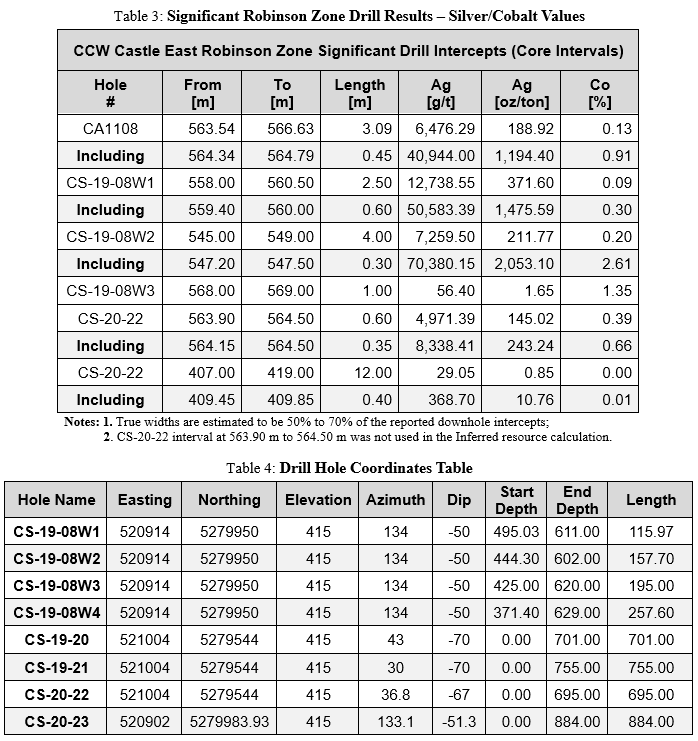

Castle East is part of Canada Silver Cobalt’s 100%-owned, 78 sq. km Castle Property also featuring the Castle mine. Late last year the company initiated a follow-up program to a 2011 discovery hole approximately two km southeast of the mine, and within two km of two other past producers, that returned a high-grade intercept of 40,944 g/t silver (1,194 oz/ton) over a core length of 0.45 meters (refer to August 25, 2011, Gold Bullion Development news release). Four holes (CS-19-08W1, CS-19-08W2, CS-19-08W3 and CS-19-W4) were wedged off the 2011 hole followed by four holes (CS-19-20, CS-19-21, CS-20-22 and 23) drilled to intersect the vein zone from a different angle. The latest hole was drilled parallel to and collared 45 meters from the historic hole. CCW’s program aimed to delineate the extent of the high-grade mineralization within the Robinson Zone that shows very high grades in the form of native silver.

The mineral resource estimate used the four wedge holes and the four holes drilled from surface (CS-19-08W1 to W4; CS-19-20, CS-19-21; CS-20-22 and CS-20-23) and one historical drill hole (CA1108).

This resource estimate was independently prepared by GoldMinds Geoservices Inc. in accordance with National Instrument 43-101 (“NI 43-101”) and is dated May 28, 2020.

Notably, Zones 1A and 1B have an average silver grade of 8,582 g/t (250.2 oz/ton) in a combined 27,400 tonnes of material for a total of 7,560,200 Inferred ounces using a cut-off grade of 258 g/t AgEq (mineral resources which are not mineral Reserves do not have demonstrated economic viability).

Notes:

1 Mineral resources which are not mineral Reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported Inferred resources are uncertain in nature and there has not been sufficient work to define these Inferred resources as Indicated or Measured resources;

2 The database used for this mineral estimate includes drill results obtained from historical (2011 one hole) to the recent 2019 drill program and wedges from the 2011 diamond drill hole;

3 Mineral resources are reported with mineable shape cut-off grade equivalent to $125 USD (258 g/t AgEq) including mining, shipping and smelting cost with recovery of 95%. The high-grade value of the mineral resources may potentially allow for direct shipping. The assay results are not capped as they are not considered as outliers at this stage and results are reproducible;

4 The geological interpretation of the mineralized zones is based on lithology and the mineralized intervals intersected by drill holes. The use of the borehole inspection camera provided a valuable geometric characterization of the mineralized intervals;

5 The mineral resource presented here was estimated with a block size of 1mE x 1mN x 1mZ;

6 The blocks were interpolated from equal length composites of 0.5m calculated from the mineralized intervals;

7 The minimum horizontal width of the mineralized envelopes includes dilution and is 1.3m;

8 The mineral estimation was completed using the inverse distance to the square methodology utilizing two passes. For each pass, search ellipsoids followed the geological interpretation trends were used;

9 The mineral resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions in 2019 and adopted by CIM Council (2020), and procedures for classifying the reported mineral resources were undertaken within the context of the Canadian Securities Administrators NI 43-101;

10 To convert volume to tonnage a specific gravity of 3.4 tonnes per cubic metre was used. Results are presented in situ without mining dilution;

11 This mineral resource estimate is dated May 28, 2020. Tonnages and AgEq oz in the table above are rounded to nearest hundred. Numbers may not total due to rounding;

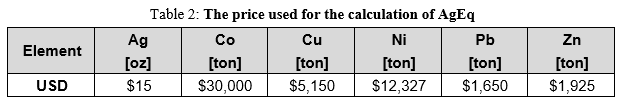

12 The table below shows the commodity prices and the formula for AgEq calculation:

13 Additional details will be provided in the Technical Report.

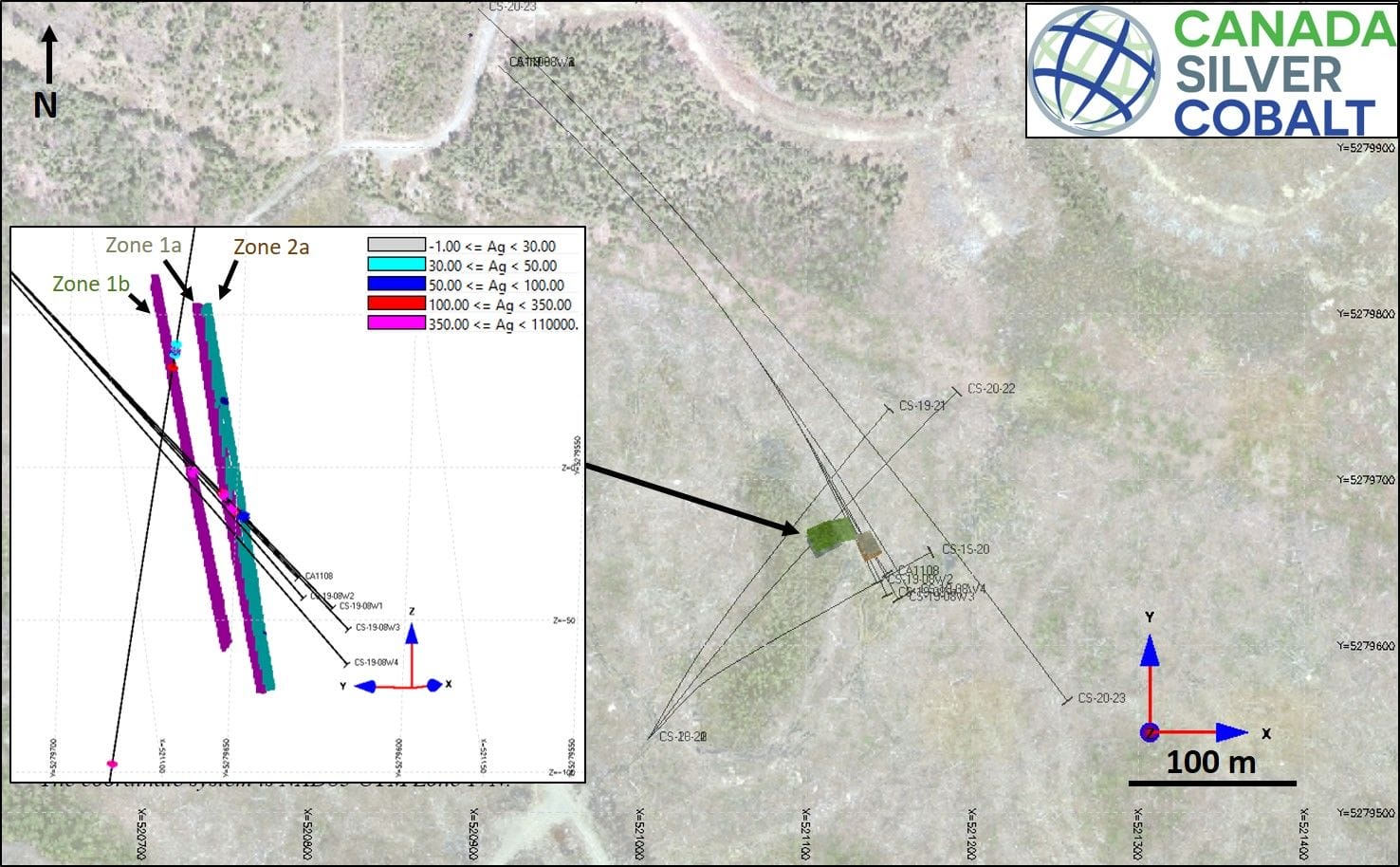

Figure 1: The location of the mineralized envelopes.

As part of the resource estimation process, the company and GoldMinds compiled, verified and modelled all technical information available from the Castle East Project. The 3D geological models were built for sub-vertical structures. The mineralized envelopes were created using the last diamond drill holes (CS-19-08W1 to W4; CS-19-20, CS-19-21; CS-20-22 and CS-20-23) and the historical hole CA1108. A total of four mineralized envelopes were created by connecting the defined mineralized prisms on the sections with a minimum horizontal width of 1.3m. A fixed density of 3.4 t/m3 was used. This density reflects the typical mineralized interval composed mainly of diabase. The geological and mineralization wireframes were constructed using Genesis©, a modelling and mineral estimation software.

The maximum depth of the mineralized envelopes is around Z = -73 m (around 490 metres from the surface). The envelopes are extended from around 350m to 490m from the surface. A total of four block models were created. The block size (1mE × 1mN × 1mZ) has been defined to respect the geometry of the envelopes.

Search ellipsoids were used for the grade estimation and follow the geological interpretation trends. Block grades were interpolated from the composites (0.5m length) within the envelopes in two passes using the inverse distance to the square methodology and the assays results are not capped.

For the first pass, the number of composites was limited to twelve (12) with a minimum of three (3) with a maximum of two (2) composites from the same hole. For the second pass, the number of composites was limited to twelve (12) with a minimum of two (2).

A cut-off grade of $125 USD (258 g/t AgEq) was applied for these underground mineral resources.

A Technical Report with respect to the present mineral resource estimate disclosed today will be filed within 45 days in accordance with NI 43-101. The report will also present more details on the project and findings. The company will continue to advance, explore and de-risk the project with further engineering (metallurgical, mining) and environmental study & social community relations with locals and First Nations.

Qualified Person

The technical information in this news release was prepared under the supervision of Mr. Merouane Rachidi, Ph.D., P.Geo., (PGO, OGQ, APEGNB and AIPG) of GoldMinds Geoservices, independent qualified person in accordance with National Instrument 43-101.

About Canada Silver Cobalt Works Inc.

Canada Silver Cobalt has 100% ownership of the Castle mine and the 78 sq. km Castle Property with strong exploration upside in the prolific past producing Gowganda high-grade Silver Camp of Northern Ontario. With underground access at Castle, a pilot plant to produce cobalt-rich gravity concentrates on site, and a proprietary hydrometallurgical process known as Re-2OX for the creation of technical grade cobalt sulphate as well as nickel-manganese-cobalt (NMC) formulations, Canada Silver Cobalt is strategically positioned to become a vertically integrated North American leader in cobalt extraction and recovery while it also exploits a powerful new silver-gold market cycle.

“Frank J. Basa”

Frank J. Basa, P. Eng.

President and Chief Executive Officer

For further information, contact:

Frank J. Basa, P.Eng.,

President and CEO

1-416-625-2342

Marc Bamber,

Director

mb@buffaloassociates.com

+44-7725-960939

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.