Canada Silver Cobalt (TSXV: CCW) | (OTC: CCWOF) Continues to Advance on Multiple Objectives

Authored By Lemuel Daher

Progress! A war on multiple fronts!

At Marketsmart, we believe that this accurately sums up the exploits of Canada Silver Cobalt Works in this past year. Yes, the Company’s been working tirelessly at a sundry of high-value assets. But is that really a surprise? Maintaining all the properties in CCW’s thrall would, of course, require constant diligence on their part.

Even so, we wouldn’t have you thinking that Canada Silver is spreading itself too thin… quite the opposite. The competence and expertise brought to bear by the Company is being expertly utilised at each and every one of their assets.

So, the only question that remains to us, here, at the head of this Commentary Corner… is where to begin?

Pictured: Matt Halliday, President, COO, and VP Exploration (left) and Frank Basa, Chairman and CEO (Right)

First of all, know that the Company financials are solid. Canada Silver has a 16 million market cap, with over 200 million shares outstanding. And because the Company is drilling as we speak, their burn rate is relatively high — with $150k per month being the typical burn rate. That said, they have a steadfast cash position of just under a million dollars.

And, believe us, their money is being put to good use.

Which brings us to Eby-Otto. Yes, the 1,000-hectare gold property is a good entry point to the recent exploits of Canada Silver… if only because this property in particular has seen considerable progress.

Again — this is hardly unexpected; especially when you consider that Eby-Otto is in close proximity to Agnico Eagle’s high-grade Macassa Mine in Kirkland Lake, Ontario — one of the highest gold grade mines in the world.

And it was May of last year that saw exploration plans kick off at the property with three critical exploration phases. To begin with, an initial site assessment was established to determine the logistics of all future operations. Said assessment was to be informed by geological mapping, the stripping of key outcrops, as well as further targeted and detailed ground geophysics… if deemed necessary by the technical team.

And guess what?

The first phase was a smash success.

Pictured: Eby-Otto Property

Thanks to EarthEX Geophysical Solutions Inc., this phase saw the Company conducting a drone magnetic survey on Canada Silver’s entire claim package. And credit for this achievement belongs to the DroneMag system, a high resolution, magnetic imaging drone equipped with a proprietary automatic obstacle avoidance system.

What’s more, said drone was able to complete the survey at a low enough altitude with tight enough line spacing — 25 meters, to be exact — for smaller structures like vein systems to be visible and identifiable!

Speaking of identification — the Company also managed to mark out several key areas for outcrop stripping and channel sampling, as well as for the placement of drill trails. And from there, the ensuing channel samples were sent to the lab for analysis… but we’d here like to highlight the placement of those aforementioned drill trails.

Because they were every bit as important.

We’d ask you to think about the dense, difficult geography of the forest and terrain at Eby-Otto. Once drilling started, naturally proper trails would be required — but the process of creating these trails enabled Canada Silver’s team to familiarize themselves with the areas as well as affording access to them.

Pictured: Terrain at Eby-Otto

Yes, the first phase of exploration work yielded up a bevy of information with respect to the Eby-Otto property. As a result, just in this past October, drilling began in earnest with a 2,000-2,500-meter drill program.

This second phase would target regional fault structures like the Cadillac-Larder Lake Break and/or the Eby-Otto Fault. Also on the table, though, were regional mapped alteration zones, areas of increased sulphides, mapped surface veins with anomalous gold mineralization, and other high potential identified areas (thanks in no small part to the drone magnetic survey).

But it’s not just the survey we have to thank for these identifications. You see, each target was based on historic geological data, regional geophysics, geological mapping, and the existing selective 2D electromagnetic (EM) surveys that were completed by accomplished geologist Doug Robinson, prior to the Canada Silver’s acquisition of the property.

And the work in this phase will prove to be instrumental in refining the next and final one.

Pictured: Work Continues at Eby-Otto

Yes, Phase 3 will see an expansion on drilling and field work at Eby-Otto. Work is literally expected to begin any minute — especially now that the technical team is able to correlate all the data gathered from the first two phases of work at the property.

As we’ve said, you can expect this information to be used to refine and adjust the exploration process at Eby-Otto… so stay tuned for more updates coming out of this promising region as we enter its closing phase!

And now that we’re all caught up to the present, perhaps this is a good time to discuss one of Canada Silver’s more recent ventures…

…so, let’s rapidly shift gears and turn toward a greenfield lithium property – one which shares a border with Power Metal’s Case Lake Lithium Property!

Pictured: Main Dyke of Power Metal’s Case Lake Lithium Property

Actually, it might be more accurate to say that this property is sandwiched between several dome-shaped laccolith igneous intrusions, all of which are owned by Power Metals.

And that’s a big deal, folks.

See, these ‘domes’ typically host the pegmatitic dykes containing spodumene. Spodumene is a lithium aluminium inosilicate, also known as a lithium ore mineral, and a pegmatite is a kind of igneous rock with a very coarse texture.

Listen — the key thing to understand here is that, at present, lithium is extracted fr om lithium brines and pegmatite deposits. Basically, these pegmatite dykes are among the primary sources of lithium today!

Pictured: Spodumene Found in Pegmatite Rock

Which is why, in our mind, a series of pegmatitic structures that border Canada Silver’s lithium property can only speak to its considerable prospects. And if that wasn’t enough to sway you — it seems that a collection of these domes trend through the property.

But why does lithium matter so much? Well, like cobalt, lithium is an important growth driver as it’s used in the batteries of electric vehicles — even as it’s used in laptop batteries, cell phone batteries, and in the glass and ceramics industry.

And here’s a fun fact for any investor with a piqued interest… the alkali metal lithium global market is currently in the midst of an exponential surge. The years between 2008 and 2018 saw annual production of lithium in major producing countries rise from 25,400 tons to 85,000 tons.

Pictured: Lithium Battery

So, in November of last year, Canada Silver signed a non-binding Letter of Intent to purchase this 24-unit multicell property in the Cochrane District, Ontario. And since signing the Letter of Intent, the Company has expanded its holdings in the Cochrane District by staking new claims to a total of 230 square kilometres.

Oh, we’d also advise you to take a good look at how Canada Silver’s property is situated just five kilometers north-west of Power Metal’s West Joe Dyke and Main Dyke areas. See, these are areas that have hosted impressive highlights for pegmatites, such as 1.11 % Lithium over 6.84m in PWM-22-128, and 1.58 % Lithium over 15.00m in PWM-22-134.

Suffice to say — keep Canada Silver’s greenfield lithium project on your watchlist, as updates are only continuing to pour in!

Without further ado, let’s move on to Canada Silver’s flagship property: Castle East. Yep, the very same Castle East in Northern Ontario that saw the discovery of a major high-grade silver vein system!

Pictured: Castle East Property (1)

It’s at Castle East that Canada Silver completed their 60,000m drill program. As we understand it, the purpose was to expand the size of the deposit and formulate an update to the resource estimate (which is underway as we speak).

But here’s the kicker — very recently, the Company fielded new assay results from the program.

And, folks, the results are fantastic.

The promising intercepts received by the Company ranged from 2,900 g/t silver and 1.05% cobalt over 0.5 meters, to 3,680.00 g/t silver over 1.01m and 1.34% cobalt over 0.47 meters, to 4,710.00 g/t silver over 0.53m and 3,020.00 g/t silver over 0.67 meters.

These results expand on the mineralization in the Big Silver Zone as well as the 61 Zone — and would naturally impel anyone endowed with good sense to drill further into the high potential Castle East deposit.

Fortunately, we know that Canada Silver has more than its fair share of good sense.

Pictured: Drilling at Castle East

And yet, before we finish up with Castle East, we’d like to quickly mention that the high-grade silver vein at Castle East is about 50 metres below the surface, which actually makes it the closest vein to surface the Company has ever drilled on the property. Based on this, an association with gold and silver is suggested; a relationship at shallow depths which no doubt will require additional investigation.

Folks, the mystery and promise of Castle East is only just beginning to unfold.

Pictured: Castle East Property (2)

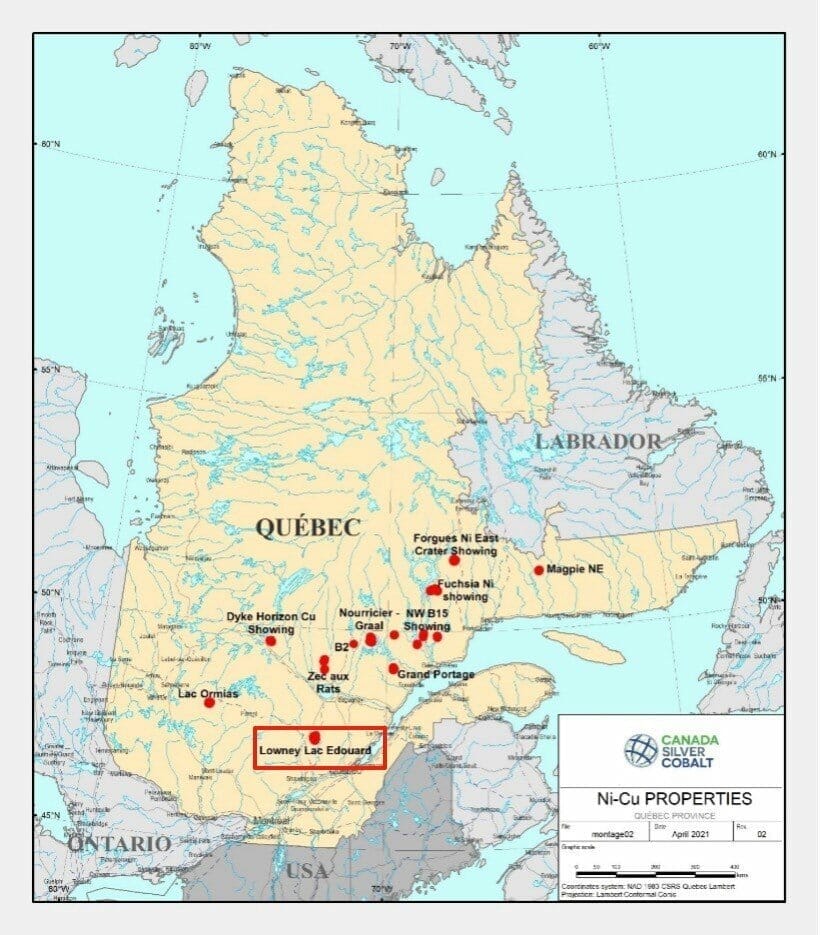

All this brings us to the Graal nickel-copper-cobalt property in the Lac St-Jean region of Quebec.

If you didn’t already know, this 6,113-hectare property is just one of 14 northern Quebec properties recently acquired by Canada Silver — all of which total 31,201 hectares, and all of which are veritable breeding grounds for EV battery metals such as nickel, copper, and cobalt.

But let’s get back to Graal. The Company has drilled 16000-17000 m, and while they aren’t currently drilling, this past December saw them conducting extra geophysics!

Pictured: Location of the Graal Nickel-Copper-Cobalt Property

For those who’ve followed Canada Silver for some time, now — you’ll know that this program was put on hold early last year to allow for the reception of pending assay data as well as the completion of the FL-TDEM survey.

But the good news is two-fold.

First, don’t forget that Canada Silver received the remainder of all pending assays from their 2021-2022 winter drill program…

…and those results were thrilling.

Pictured: Work at Graal

Almost every drill hole intersected disseminated-to-massive sulphides with nickel-copper-cobalt mineralization! But also consider that the Company is looking to spin out Graal!

Everything we’ve talked about thus far should prove that this property can stand on its own. Indeed, as President Matt Halliday says, Graal may even need to leave the silver-cobalt umbrella to really shine. Expect a share in this spin-out to go to current shareholders, along with a half-warrant.

Also consider that this arrangement affords Canada Silver more time to focus on their infamous Cobalt Camp!

Pictured: Graal Property

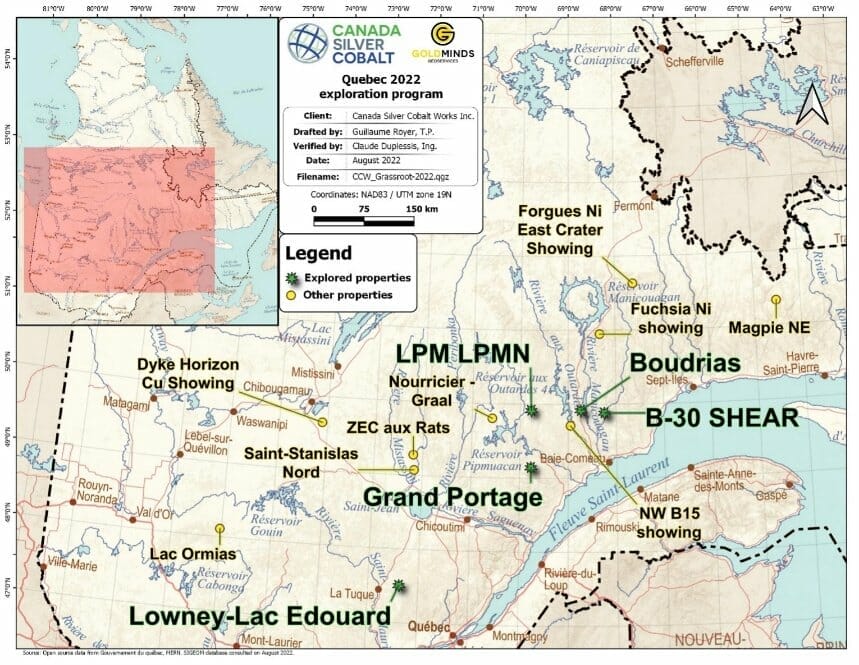

A little earlier, we mentioned the 14 battery metal properties in Quebec. Well, as we move toward wrapping up this Commentary Corner, let’s hone in on just five of these 14 properties.

As in, the five properties where grassroots exploration work has commenced. Those being Grand Portage, LPM-LPMN, Boudrias (North and South), and B30 Shear — each of which is located on the North Shore of the St. Lawrence River.

To explore them properly, Canada Silver’s technical team used existing logging roads and ATV/walking trails. Thanks to their diligence with respect to prospecting favorable rock types, access reconnaissance, and utilizing the Beep Mat to locate conductors — Canada Silver was able to successfully identify conductive rock and retrieve channel samples through use of a rock saw.

From there, the technical team collected thirty-five samples and sent them to a laboratory. Right now, the Company is awaiting assay results which are to be disclosed once received and validated — so, let’s now address the fifth EV property: Lowney-Lac Edouard.

Pictured: Location of CCW Properties in Quebec (1)

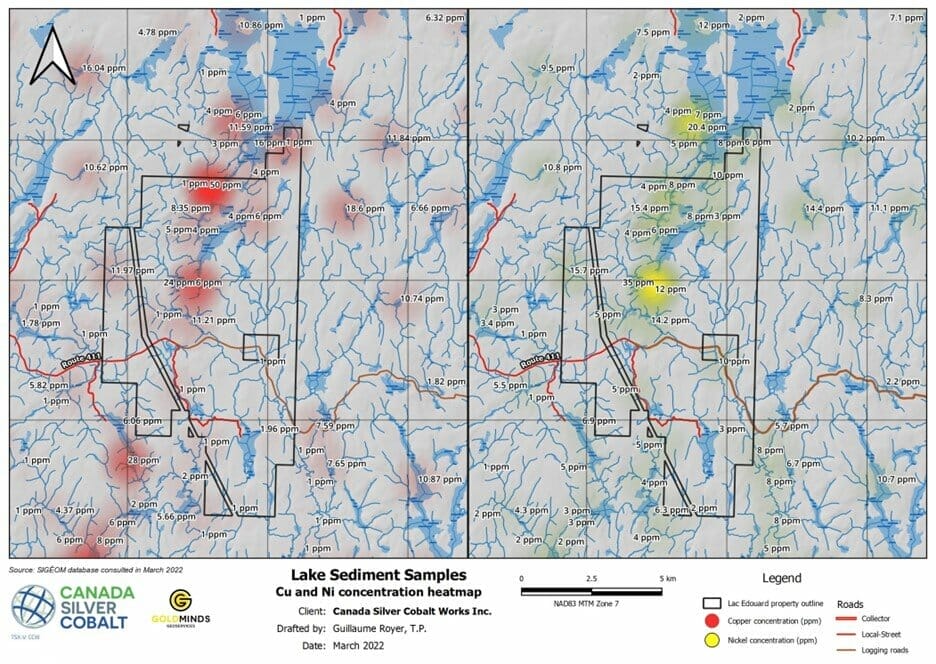

For those who don’t already know, this property is close to the past producing nickel-copper Lac Edouard Mine that boasts grades of 1.5% nickel and 0.5% copper. But this alone isn’t why the technical team has taken such a severe interest in the property.

Consider, now, the significant regional gravity anomaly that was identified by a previous airborne SGL survey, or the favorable geological context of a lithological unit which appears to correlate with said anomaly.

And there’s another correlation with that regional gravity anomaly: look to the lake sediment samples at Lowney-Lac Edouard, as they returned elevated nickel and copper

Pictured: Lowney-Lac Edouard Property Location and Heat Map

This is why an airborne VTEM survey was completed over the property. The objective? To identify near surface conductors to help guide field work.

The survey was conducted by Geotech, a global leader in technological innovation for airborne geophysical survey mapping, interpretation, and analysis. And it’s thanks to their hard work that five anomalies have been identified.

Once again, investors should be watching closely! Once all the data has been reviewed, Canada Silver plans to waste no time in following up the results of this survey!

Pictured: Location of CCW Properties in Quebec (2)

So, what can we really say, in summation?

It may be understating things if we claimed that this past year was simply a… productive one for Canada Silver. Considering what has been achieved, we think the technical teams at the Company deserve a hearty round of applause.

But momentum at Canada Silver Cobalt Works shows no sign of slowing.

We’re at a critical point, folks. The Company is awaiting results from certain assets, watching exploration work proceed at others. To those who are on the fence about Canada Silver, if you’re ever going to invest — now is the time. And to those who are already investors — hold on.

With all that said, if there’s been one singular overarching theme of this Commentary Corner, we think it’d be this: stay tuned!